Thursday, August 31, 2006

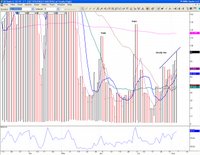

NDX and QQQQ close August below their respective 20 month moving average. Granted, it was close, but nevertheless that will mark a first since 2000 that we perform this feat for three consecutive months (after a bull run). The saving grace for techs will be the COMP which managed a close above.

As much as I want to discard this as an anomaly which will be quickly corrected, I don't have to remind readers that the NASDAQ 100 is a bellwether index. Let's see what happens in the coming weeks and how big firm trading computers will react. Exercise caution and above all, patience. For QQQQ, we need to consistently start closing above 39 and for NDX it is 1584. The good news is that puts are building at the 39 strike and that could be supportive in September.

The docket is loaded tomorrow with the jobs report pre-open, followed by consumer sentiment, construction spending and ISM. Expect some serious volatility early on, which could taper off into a flatline as the session closes.