The jobs numbers on Friday was the last nail in the coffin for those inflation wackos dreaming of another rate hike. With futures showing less than 15 percent chance of such an occurrence, we can pretty much rest assured Bernanke will pause. I think he will make some hawkish comments just to appease some, but the bottom line is that the economy cannot afford higher interest rates. In fact, we should see some easing later in the year.

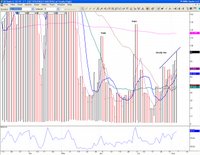

How will the markets react? Hard to say. Most are predicting a bounce that will fizzle out. I am not so sure. It will all depend on the pre-event reaction and the sentiment leading into it. We could very well have initial selling, just to flush out the weak hands. But after he dust settles, August could be quite bullish with a sustained rally that could surprise many. The NASDAQ new 52 week highs is getting some upward momentum just as the new 52 week lows flattens out and drops. If you look at the chart of new 52 week lows (chart 1), you can see how May and July had short lived lows that looked like typical bear market headfakes. The drop in new lows the past ten days no longer fits that pattern: it has not gone as far, but notice how bears are unable to press on. If we turn to the NASDAQ new 52 week highs (chart 2), we can see a steady rise, as opposed to the previous one or two day events. Watch this pattern, it could be the proverbial canary in the mine.